[ FACE SIGNATURE ]

Next Generation Payment System, get ready to enter the age of face recognition

Facial recognition technology has changed the world of digital payment. Customers can make purchases without any cash, bank card or smart phone with this advanced innovation. As the Face Signature technology has been stepped up in the rising numbers of sectors, Face recognition technology is growing rapidly in the immediate future to replace conventional digital payments. It is time to bid farewell to pincodes/passwords and get ready to enter the age of face recognition.

Face Signature providing a tool to financial institutions to make easily and effectively authenticate users of their online and mobile banking user to pay without your phone or wallet. Only smile at the register for the camera, verify your ID and then authorize your account for the payment. A returning user used facial-recognition payment to pay in 2 steps within 10 seconds.

Face Signature provide higher security standards than other security tools for payments via biometric identity verification. Like the crimes perpetrated by other forms of payment systems, this is almost hard to break. Another benefit is that the Face Signature technology for facial payment is relatively easy to incorporate into a current payment system. As our technology does not need any touch or machine, it is faster, simpler, and more versatile than mobile payments or fingerprints verification.

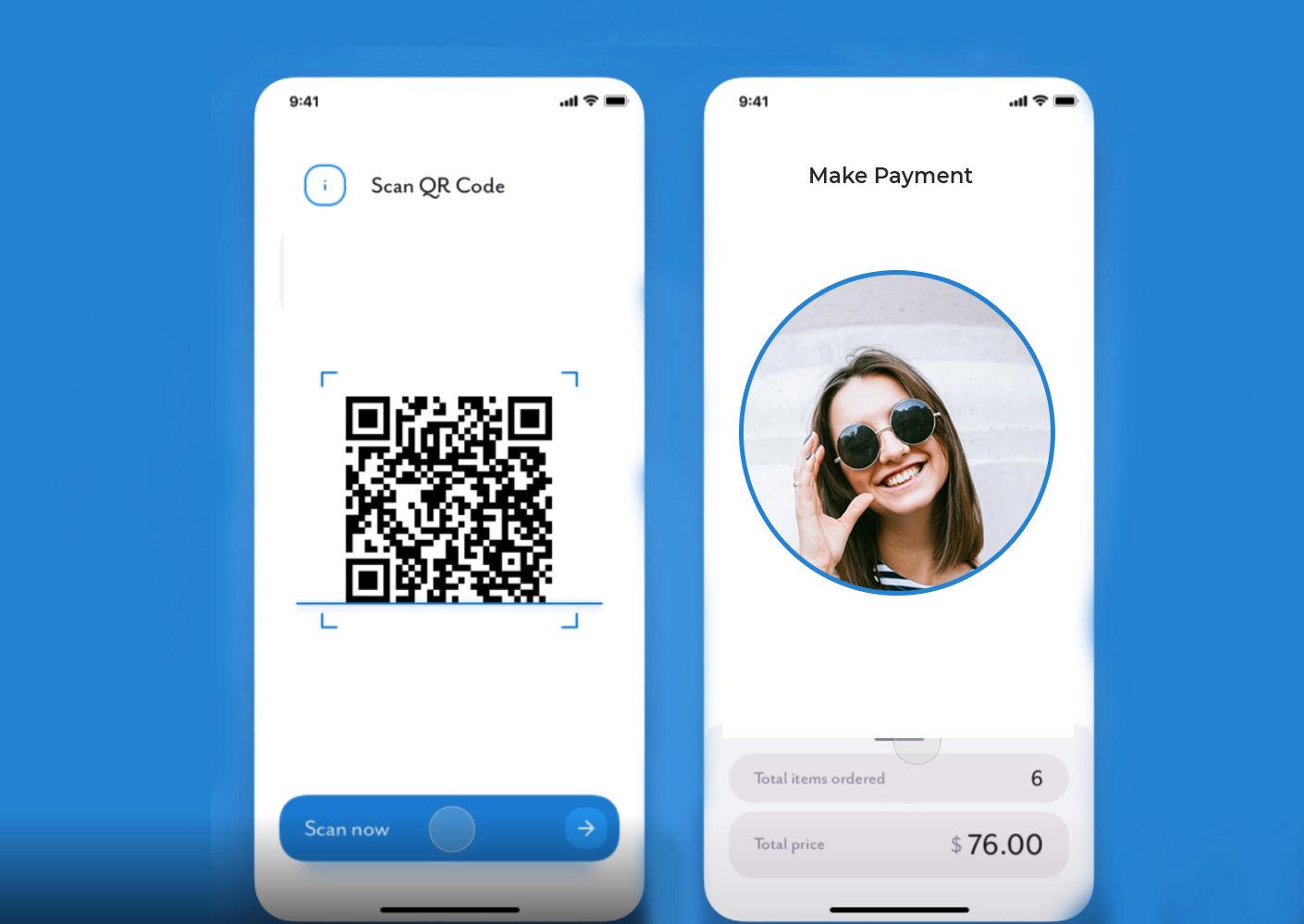

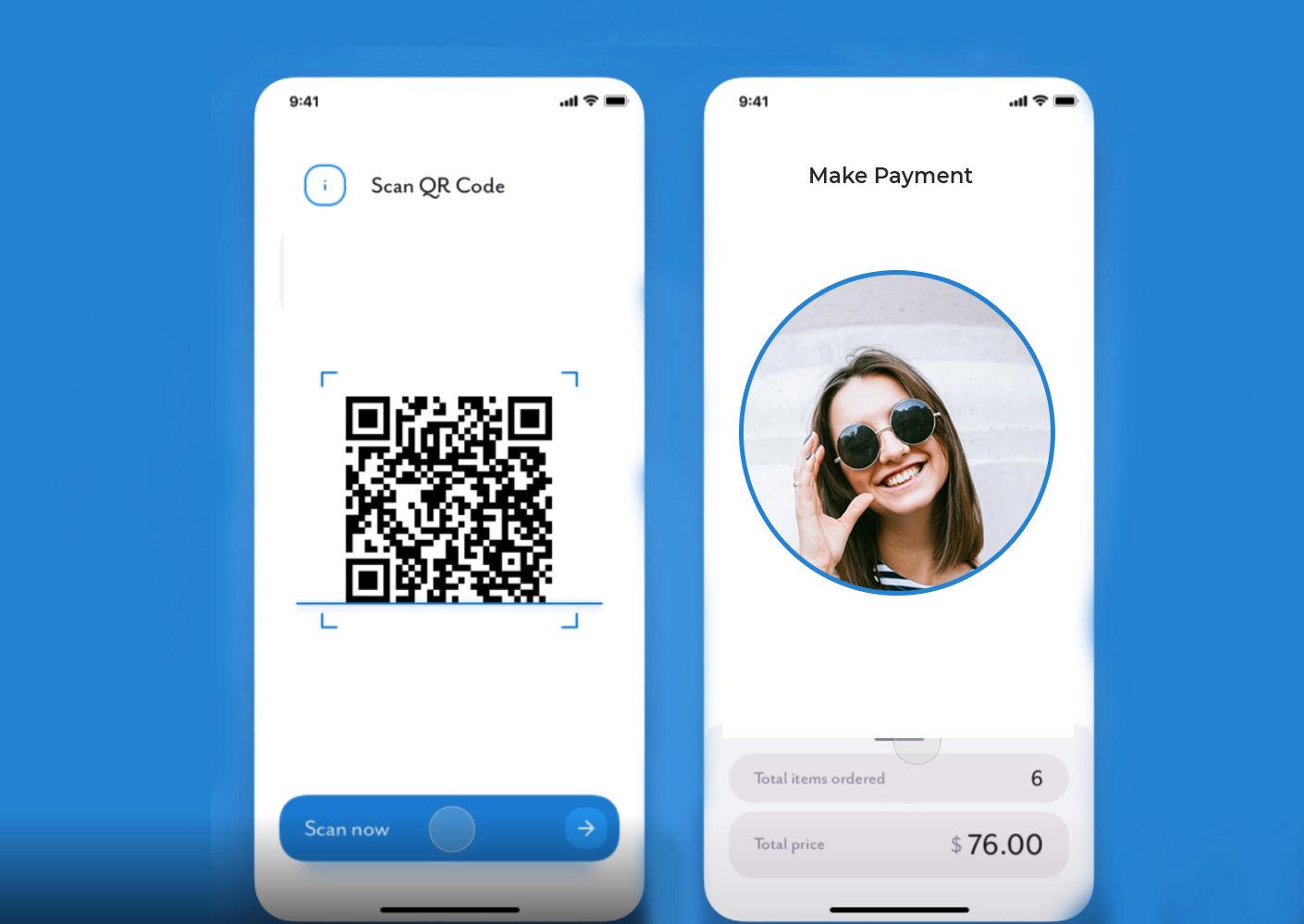

Face Signature fast and advance wallet-free technology is largely due to QR-code scanning, people scan the QR code of a shop and pay the amount of the order on their phones. Face Signature Facial recognition technology for financial institutions takes this process a step further — you don’t even need your phone, just your face.

The cashier enters the amount of money for the order, which is then shown on the device screen. A user just needs 10 seconds and two taps to finish the payment:

- 1. The user taps Pay with Face Recognition on the screen of the device. The device scans the face and recognizes the user.

- 2. The user then taps Confirm Payment and is done.